Electric Vehicle Credit Irs Form . You can claim the credit yourself. treasury and the internal revenue service released guidance and faqs with information on how the north. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit.

from www.templateroller.com

we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. treasury and the internal revenue service released guidance and faqs with information on how the north. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit yourself.

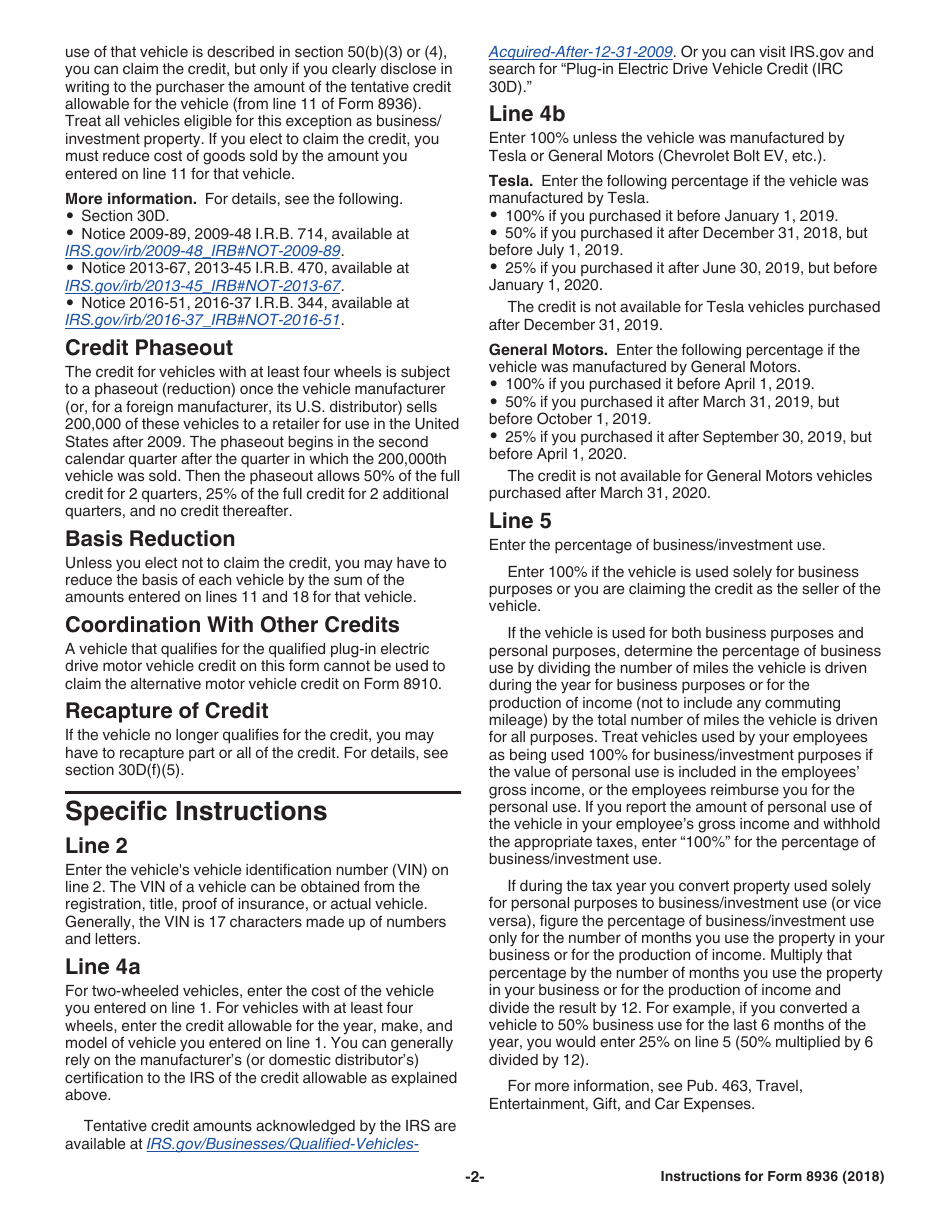

Download Instructions for IRS Form 8936 Qualified PlugIn Electric

Electric Vehicle Credit Irs Form tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. treasury and the internal revenue service released guidance and faqs with information on how the north. You can claim the credit yourself. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles.

From www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric Electric Vehicle Credit Irs Form tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit yourself. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. treasury and the internal revenue service released guidance. Electric Vehicle Credit Irs Form.

From www.templateroller.com

IRS Form 8834 Download Fillable PDF or Fill Online Qualified Electric Electric Vehicle Credit Irs Form we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. You can claim the credit yourself. treasury and the internal revenue service released guidance and faqs with information on how the north. tax credits up to $7,500 are available for eligible new electric vehicles and. Electric Vehicle Credit Irs Form.

From www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric Electric Vehicle Credit Irs Form we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. You can claim the credit yourself. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. treasury and the internal revenue service released guidance. Electric Vehicle Credit Irs Form.

From www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric Electric Vehicle Credit Irs Form tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit yourself. treasury and the internal revenue service released guidance and faqs with information on how the north. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel. Electric Vehicle Credit Irs Form.

From www.pdffiller.com

Fillable Online irs 2001 Form 8834. Qualified Electric Vehicle Credit Electric Vehicle Credit Irs Form treasury and the internal revenue service released guidance and faqs with information on how the north. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used. Electric Vehicle Credit Irs Form.

From mechanicjjanggle.z14.web.core.windows.net

Plug In Hybrid Eligible For Tax Credit Electric Vehicle Credit Irs Form You can claim the credit yourself. treasury and the internal revenue service released guidance and faqs with information on how the north. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. tax credits up to $7,500 are available for eligible new electric vehicles and. Electric Vehicle Credit Irs Form.

From www.formsbank.com

Fillable Form 8834 Qualified Electric Vehicle Credit printable pdf Electric Vehicle Credit Irs Form You can claim the credit yourself. treasury and the internal revenue service released guidance and faqs with information on how the north. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel. Electric Vehicle Credit Irs Form.

From www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric Electric Vehicle Credit Irs Form tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit yourself. treasury and the internal revenue service released guidance and faqs with information on how the north. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel. Electric Vehicle Credit Irs Form.

From www.teachmepersonalfinance.com

IRS Form 8936 Instructions Qualifying Electric Vehicle Tax Credits Electric Vehicle Credit Irs Form treasury and the internal revenue service released guidance and faqs with information on how the north. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. Electric Vehicle Credit Irs Form.

From turbo-tax.org

Have A New Electric Car? Don't To Claim Your Tax Credit! Turbo Tax Electric Vehicle Credit Irs Form we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. You can claim the credit yourself. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. treasury and the internal revenue service released guidance. Electric Vehicle Credit Irs Form.

From www.templateroller.com

IRS Form 8834 Fill Out, Sign Online and Download Fillable PDF Electric Vehicle Credit Irs Form tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit yourself. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. treasury and the internal revenue service released guidance. Electric Vehicle Credit Irs Form.

From getelectricvehicle.com

Electric Car Tax Credit Everything that You have to know! Get Electric Vehicle Credit Irs Form tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. treasury and the internal revenue service released guidance and faqs with information on how. Electric Vehicle Credit Irs Form.

From www.templateroller.com

IRS Form 8936 Download Fillable PDF or Fill Online Qualified PlugIn Electric Vehicle Credit Irs Form we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit yourself. treasury and the internal revenue service released guidance. Electric Vehicle Credit Irs Form.

From www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric Electric Vehicle Credit Irs Form tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. You can claim the credit yourself. treasury and the internal revenue service released guidance. Electric Vehicle Credit Irs Form.

From www.formsbirds.com

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014 Electric Vehicle Credit Irs Form treasury and the internal revenue service released guidance and faqs with information on how the north. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used. Electric Vehicle Credit Irs Form.

From www.teachmepersonalfinance.com

IRS Form 8936 Instructions Qualifying Electric Vehicle Tax Credits Electric Vehicle Credit Irs Form tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. treasury and the internal revenue service released guidance and faqs with information on how the north. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. Electric Vehicle Credit Irs Form.

From www.formsbirds.com

Form 8834 Qualified Electric Vehicle Credit (2014) Free Download Electric Vehicle Credit Irs Form You can claim the credit yourself. we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. treasury and the internal revenue service released guidance. Electric Vehicle Credit Irs Form.

From innoem.eng.psu.ac.th

Electric Vehicle Tax Credit Form Sale innoem.eng.psu.ac.th Electric Vehicle Credit Irs Form we'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit. You can claim the credit yourself. tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. treasury and the internal revenue service released guidance. Electric Vehicle Credit Irs Form.